ROUYN-NORANDA, CANADA, May 26, 2022 – Abcourt Mines Inc. (“Abcourt” or the “Corporation”) (TSX Venture: ABI), declares results for the third quarter ended on March 31, 2022, compared to the third quarter ended on March 31, 2021. All amounts are in canadian dollars unless indicated differently.

HIGHLIGHTS :

| • |

Revenues of $4,175,745 for the quarter ended March 31, 2022 compared to $4,813,520 in 2021, a 14% decrease, explain by fewer ounces of gold sold and lower-than expected tonnes. |

| • |

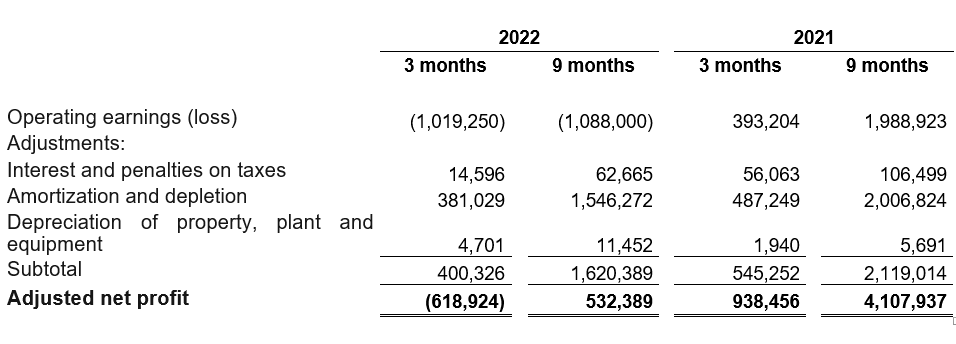

A net loss of $1,042,208 compared to a net profit of $367,413 at March 31, 2021 explain by fewer ounces of gold sold and lower than expected tonnes. |

| • |

Adjusted loss of $618,924, compared to adjusted net income of $938,456 for the same period in 2021. |

| • |

Cost of sales of $4,957,471, compared to $4,114,284 for the same quarter of 2021, an increase of 20% which is due to the increase in material and labor costs as well as the problems encountered in supply chains. |

| • |

Cash of $1,057,141, compared to $2,454,645 as at June 30, 2021. Working capital of $(4,370,888) compared to $(413,103) as at June 30, 2021. The decrease in cash is due to lower operating cash flows and higher investment in property, plant and equipment. |

| • |

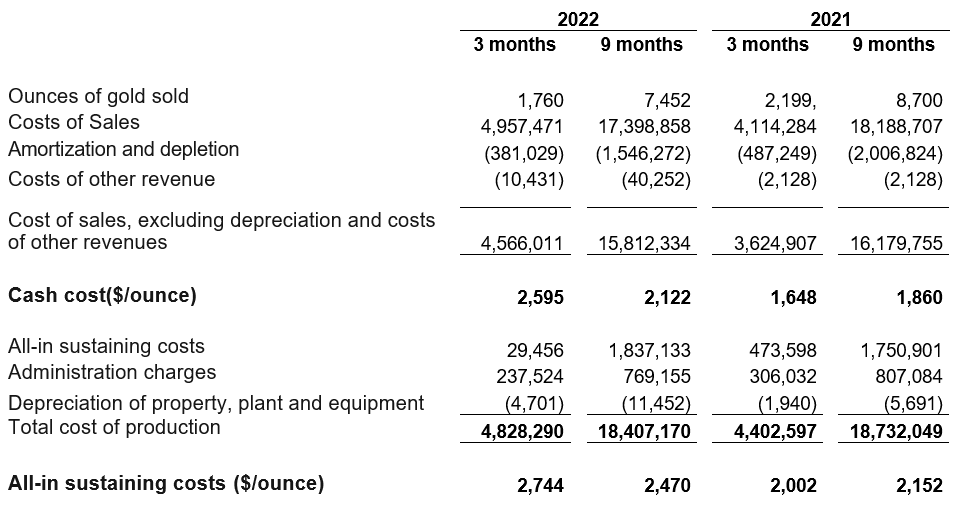

Cash cost of $2,595 ($2,060 US), compared to $1,648 ($1,314 US) and all-in sustaining cots of $2,743 ($2,178 US) compared to $2,002 ($1,596 US) per ounce sold for the corresponding period in 2021. The increase in the cash cost is explain by the decrease in the number of ounces of gold sold by 20% compared to the same period in 2021 and by the decrease the expected tonnes. During the quarter, the cash cost is higher than the realized average price per ounce of gold sold of $2,363. |

| • |

1,791 ounces of gold produced for the quarter compared to 2,360 ounces for the same period in 2021. 1,760 ounces of gold sold for the quarter compared to 2,199 ounces for the same period in 2021. A 24% decrease in ounces of gold produced and a 20% decrease in ounces of gold sold. The decrease in the ounces of gold produced and sold is due to lower-than expected tonnes cause by the depletion of the mine’s economic resources. |

| • |

Sales of 451 ounces of gold from development work at Sleeping Giant Mine for a total of $1,076,058, sales of 137 ounces of gold for a total of $298,832 during the same period in 2021. |

NON-GAAP FINANCIAL PERFORMANCE MEASURES:

This press release presents certain financial performance measures, total cash costs per ounce of gold produced, sustaining costs and all-in sustaining cost per ounce of gold produced which are non-International Financial Reporting Standards (IFRS) performances measures. This data may not be comparable to data presented by other gold producers. Non-GAAP financial performance measures should be considered together with other data prepared in accordance with IFRS.

The adjusted net profit is a measure of performance that members of the direction use to evaluate the performance of activities by the Corporation. Without taking into account the accounting policies, taxation laws and the structure of capital as these elements may potentially give a wrong representation of the capacity of the Corporation to generate cash with its operation. The adjusted net profit excludes interest expenses, taxes and amortization.

The cash costs and all-in sustaining cost are common performance measures in the gold mining industry. The Corporation reports cash cost per ounce based on ounces produced. Cash cost include operating mining costs and royalties but is exclusive of amortization and depletion and sustaining capital expenditures. The all-in sustaining costs include costs of sales and sustaining capital expenditures and administrative costs but exclude amortization, depletion and accretion expenses. The Corporation believes that all-in sustaining costs present a complete picture of the Corporation’s operating performance or its ability to generate free cash flows from its operation.

CALCULATIONS OF CASH COST AND SUSTAINING COSTS

ADJUSTED NET PROFIT FOR THE QUARTER (FINANCIAL MEASURES NOT DEFINED BY IFRS)

ABOUT ABCOURT MINES INC.

Abcourt Mines Inc. is a Canadian gold exploration company with properties strategically located in northwestern Quebec, Canada. Abcourt owns the Sleeping Giant mill and mine where it concentrates its activities.

For more information about Abcourt Mines Inc., please visit our web site at www.abcourt.com and consult our filings under Abcourt’s profile on www.sedar.com.

| Pascal Hamelin,

President and CEO T : (819) 768-2857 |

Dany Cenac Robert, Investor Relations

Reseau ProMarket Inc., T: (514) 722-2276 post 456 |

The TSX Venture Exchange and its regulatory service provider (as defined in the policies of the TSX Venture Exchange) assume no responsibility for the adequacy or accuracy of this press release.