Rouyn-Noranda, Québec, Canada, February 15, 2022 Abcourt Mines Inc. (TSX-V: ABI, Berlin: AML-BE and Frankfurt Stock Exchanges: AML-FF) (“Abcourt” or the “Corporation”), declares results for the second quarter ended on December 31, 2021, compared to the second quarter ended on December 31, 2020. All amounts are in Canadian dollars unless indicated differently.

HIGHLIGHTS:

• Revenues of $6,244,370 for the quarter ended December 31, 2021, compared to $8,360,494 in 2020, a 25% decrease, justified by lower gold prices and fewer ounces of gold sold.

• A net loss of $703,322 in 2021 compared to a net profit of $454,583 at December 31, 2020 explained in part by a decrease in the number of ounces of gold sold and an increase in production costs due to absences related to Covid-19.

• Adjusted loss of $108,774 in 2021 compared to adjusted net income of $1,381,572 in 2020.

• Cost of sales of $6,648,137 in 2021, down 13% from $7,513,877 in 2020.

• Cash of $1,031,955 as at December 31, 2021 compared to $2,454,545 as at June 30, 2021.

• Gold inventory of $l,960,197 in 2021, compared to $994,624 at December 31, 2020, an increase of 97%.

• Cash cost in Q2 of $2,197 (US $1,752), compared to $1,961 (US $l,518) and all-in sustaining cots of $2,693 (US $2,147) compared to $2,221 (US $1,719) per ounce sold in 2020.

• Ounces produced in 2021 were 2,103 compared to 2,730 in 2020. Ounces sold in 2021 were 2,765 compared to 3,431 in 2020, a 23% decrease in ounces produced and a 20% decrease in ounces sold.

• Sales of 400 ounces of gold from development work at Sleeping Giant Mine for a total of $903,856 in the 2nd quarter ended December 31, 2021. No sale in the 2nd quarter of 2020.

RECENT DEVELOPMENTS:

• Advancement of drifts on levels 11, 12 and 16 and preparation of level 13 at the Elder mine to have access to existing resources, or to discover new resources.

• Rehabilitation of old drifts and advancement of new drifts on the upper levels of the Sleeping Giant mine to have access to existing ore reserves and new zones indicated by previous and current drill holes.

NEW PROJETS TO COME:

• Update of NI 43-101 resources calculations of Discovery, Flordin and Cameron Shear (50%)

• Surface drilling program at the Sleeping Giant Mine.

• Re-activate the Abcourt-Barvue silver-zinc project.

• Construction of a trail to access the Tagami project.

NON-GAAP FINANCIAL PERFORMANCE MEASURES:

This press release presents certain financial performance measures, total cash costs per ounce of gold produced, sustaining costs and all-in sustaining cost per ounce of gold produced which are non-International Financial Reporting Standards (IFRS) performances measures. This data may not be comparable to data presented by other gold producers. Non-GAAP financial performance measures should be considered together with other data prepared in accordance with IFRS.

The adjusted net profit is a measure of performance that members of the direction use to evaluate the performance of activities by the Corporation. Without taking into account the accounting policies, taxation laws and the structure of capital as these elements may potentially give a wrong representation of the capacity of the Corporation to generate cash with its operation. The adjusted net profit excludes interest expenses, taxes and amortization.

The cash costs and all-in sustaining cost are common performance measures in the gold mining industry. The Corporation reports cash cost per ounce based on ounces produced. Cash cost include operating mining costs and royalties but is exclusive of amortization and depletion and sustaining capital expenditures. The all-in sustaining costs include costs of sales and sustaining capital expenditures and administrative costs but exclude amortization, depletion and accretion expenses. The Corporation believes that all-in sustaining costs present a complete picture of the Corporation’s operating performance or its ability to generate free cash flows from its operation.

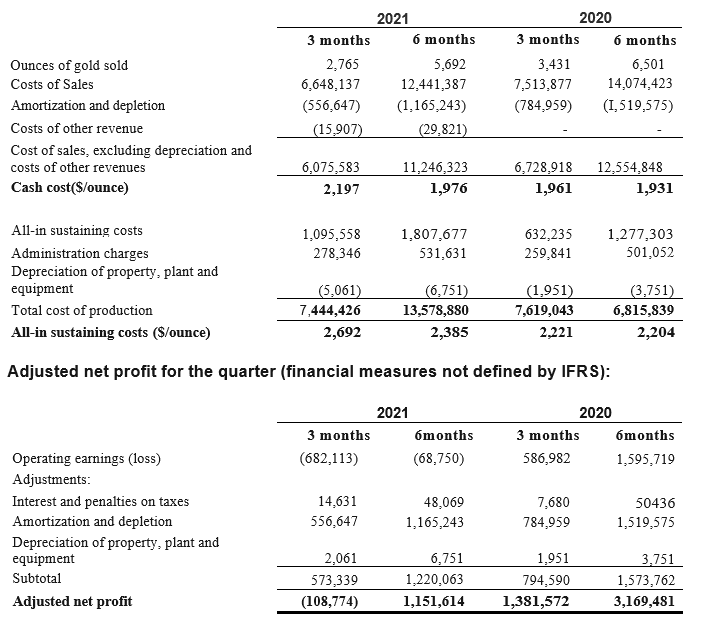

Calculations of cash cost and sustaining costs:

ELDER MINE

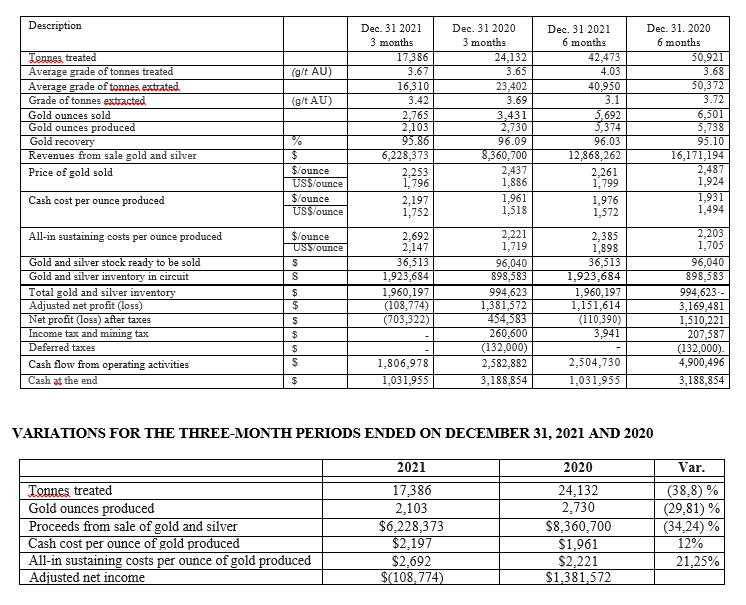

TABLE COMPARING RESULTS FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2021 AND 2020

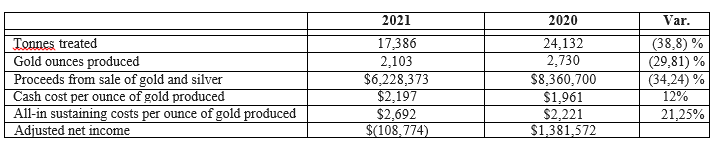

VARIATIONS FOR THE THREE-MONTH PERIODS ENDED ON DECEMBER 31, 2021 AND 2020

ABOUT ABCOURT MINES INC.

Abcourt Mines Inc. is a gold producer and a Canadian exploration company with strategically located properties in northwestern Quebec, Canada. The Elder property has gold resources (2018). Abcourt is currently focusing on the exploitation of the Elder mine and on the development of the Sleeping Giant mine.

In 2016, Abcourt acquired the Sleeping Giant mine and mill, located half-way between Amos and Matagami, in Abitibi. The mill has a capacity of 700 to 750 tonnes per day. An evaluation of the mineral resources, according to NI 43-101 was prepared in 2019 by Valère Larouche, Engineer in geology. Measured mineral resources total 10,900 tonnes with a grade of 12.20 g/t of gold and indicated resources total 475,625 tonnes with a grade of 11.20 g/t of gold. Inferred resources are 93,100 tonnes with a grade of 11.85 g/t of gold. A NI 43-101 feasibility study was completed in 2019 by PRB Mining Services Inc. Probable reserves have been estimated at 339,221 tonnes with a grade of 7.8 g/t of gold (85,690 ounces).

A resource estimate for the Abcourt-Barvue property was prepared according to NI 43-101 by Jean-Pierre Bérubé, Engineer in geology, in 2014. This estimate indicated of 8,083,000 tonnes of measured and indicated resources with a grade of 55.45 g/t of silver and 3.06 % of zinc. A feasibility study was done in 2007, according to NI 43-101 by Roche/Genivar and an update by PRB Mining Services Inc. in 2018. Proven and indicated resources total 8,074,162 tonnes with a grade of 51.79 g/t of silver and 2.83% zinc, including 6,589,361 tonnes (81.6%) mineable by open pit and 1,454,801 tonnes (18.4%) mineable underground. The feasibility study was done with the following prices: zinc at $US 1.10/lb ($CDN 1.38), silver at $ US 16.50/oz ($CDN 20.63/oz) and a rate of exchange of $US 1.00 = CDN.

This press release was prepared by Mr. Renaud Hinse, Engineer and President of Abcourt Mines Inc. Mr. Hinse is a “Qualified Person” under the terms of Regulation 43 101. Mr. Hinse has approved the content and the disclosure in this press release.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements that include risks and uncertainties. When used in this news release, the words “estimate”, “project”, “anticipate”, “expect”, “intend”, “believe”, “hope”, “may” and similar expressions, as well as “will”, “shall” and other indications of future tense, are intended to identify forward-looking statements. The forward-looking statements are based on current expectations and apply only as of the date on which they are made. Except as may be required by law, the Corporation undertakes no obligation and disclaims any responsibility to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise.

The factors that could cause actual results to differ materially from those indicated in such forward-looking statements include changes in the prevailing price of gold, the Canadian-United States exchange rate, grade of ore mined and unforeseen difficulties in mining operations that could affect revenue and production costs. Other factors such as uncertainties regarding government regulations could also affect the results. Other risks may be set out in Abcourt’ annual and periodic reports. The forward-looking information contained herein is made as of the date of this news release.

For more information on Abcourt Mines inc., please consult our website www.abcourt.com and our profile on SEDAR www.sedar.com

Renaud Hinse, President and CEO

T : 819 768-2857 450 446-5511

F : 819 768-5475 450 446-3550

Email: rhinse@abcourt.com

Dany Cenac Robert, Investor Relations

Reseau ProMarket Inc.,

T: (514) 722-2276 post 456

Dany.Cenac-Robert@ReseauProMarket.com

The TSX Venture Exchange and its regulatory ser

vice provider (as defined in the policies of the TSX Venture Exchange) assumes no responsibility for the adequacy or accuracy of this press release.